As a cancer patient, you are likely to face challenges you’ve never experienced, including the health care costs that come with diagnosis, treatment and lifestyle changes.

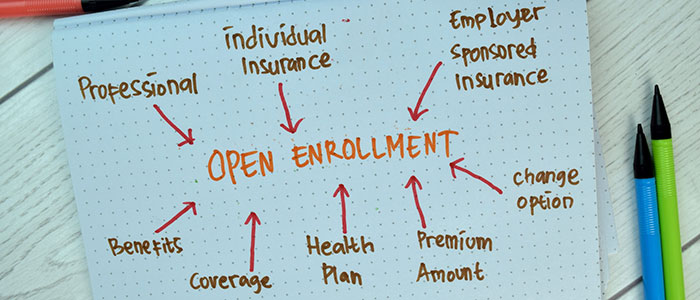

It is important to understand your health insurance options and what benefits are available to you as a cancer patient, not only to your financial health, but also to your physical and mental health. With open enrollment —the time when health insurance plans are accepting new and returning applicants for 2024 — starting soon, now is the time to understand your choices and make wise selections to help avoid or mitigate unnecessary costs.

In this article, we’ll explore insurance terms and options that may be confusing and frustrating for patients and their caregivers. Topics include:

- Health insurance terms to know

- Types of health insurance

- Questions to ask before selecting a plan

- Does insurance cover cancer treatment?

- Does insurance cover cancer screening?

- When to consider a health savings account

- Short-term disability for cancer

- Other health benefits to consider

If you’ve been diagnosed with cancer and are interested in a second opinion on your diagnosis and treatment plan, call us or chat online with a member of our team.

Health insurance terms to know

Knowing health insurance lingo is the first step to ensuring you choose wisely and fully understand the benefits you are entitled to and the costs you can expect. Some common terms are listed below.

Deductible: The amount you must pay out of pocket before your health insurance plan begins to pay for your care and services. For instance, if you have a $1,000 deductible on your health insurance plan, you will need to pay that amount for any health care services you receive before your health insurance begins to pay.

Premium: The amount you pay, usually each month, for your health insurance coverage.

High deductible health plan (HDHP): With this type of health insurance plan, the amount you must pay before your health insurance plan begins — your deductible — is high. The government considers any health insurance plan with an annual deductible of $1,600 or more for an individual and $3,200 for a family to be an HDHP. In the past, you may have selected a HDHP because the monthly premiums were low and you didn’t anticipate needing health care services that would require paying your deductible.

If you do have an HDHP, you may be eligible for a health savings account (HSA), which can help offset some expenses and has some tax advantages.

Out-of-pocket maximum: This is the most you’ll be asked to pay out of your own funds toward deductibles, co-pays or co-insurance before your health insurance plan will pay 100 percent for eligible services, medications and other benefits.

This is an important number to keep in mind for financial planning and it’s important to be aware of what benefits are included toward this maximum amount since those that are provided out-of-network or are drugs or items not covered by your health insurance plan may not count toward this maximum or may not be paid for once you reach your maximum out-of-pocket amount.

Co-pay: The amount you may have to pay at the time you visit a doctor or receive a service. This payment may vary depending on the type of doctor or service you access and will count toward your out-of-pocket maximum. Be sure to review what your health plan’s co-pays are when selecting health insurance since these out-of-pocket charges can add up.

Co-insurance: After you have paid your deductible, it is likely you will share a percentage of the cost of the health care services you receive with your health insurance plan in an arrangement called co-insurance. For instance, if your deductible is $1,000, once you have spent that amount, your health insurance plan may pay 80 percent of future charges while you will be responsible for the remaining 20 percent. The money you spend on co-insurance will accrue toward your out-of-pocket maximum and once that maximum amount is reached, the health plan will cover 100 percent of charges going forward.

In-network/out-of-network: To help you decide which health plan to choose, review which providers or organizations are in that plan’s network. Health insurance companies negotiate contracts with certain doctors and institutions and those are considered in-network and likely will be included as part of your eligible benefits. Providers or institutions outside of the network, may be partially covered or not at all, so be sure to check to see if your doctor or organization is included in the health plan’s network and what the cost will be if you seek care outside of the network.

Cancer insurance: This is a supplemental insurance plan that is designed to cover out-of-pocket costs not covered by your primary health insurance plan as well as non-medical expenses including child care costs and lost wages due to your illness. Those who already have been diagnosed with cancer are usually ineligible for this type of coverage. Shop around and review these policies carefully to be sure they enhance your overall plan rather than create more limitations. A related type of insurance, catastrophic illness insurance, may be added to your regular health insurance or life insurance plan to cover the added expense of treating and living with an illness like cancer.

Types of health insurance

Health insurance plans come in all shapes and sizes and are offered by the government as well as private employers. Here are some options to consider depending on your unique circumstances.

Government-funded plans include:

Medicare

Medicare is the government-funded health insurance program for those age 65 and older and for some people with disabilities or End-Stage Renal Disease. Within the Medicare program options may be available for coverage, including Medicare Advantage plans, which supplement the basic Medicare coverage.

Medicaid

This health insurance program is jointly funded by federal and state government that covers eligible low-income households, the elderly and disabled. Medicaid is administered by each state, so guidelines may vary.

Tricare

Active U.S. military personnel and their families, National Guard members, reservists, survivors and some former spouses may be covered by this insurance plan. Care may be provided through the military health system or through civilian providers and organizations. If you are a military veteran, visit the U.S. Department of Veterans Affairs website offers information about available benefits and eligibility.

Private health insurance plans

Private health insurance plans are marketed and administered through the health insurance industry, which is regulated by state and federal laws. These plans can be accessed through your employer or organization. Check with the human resources department where you work or your trade or professional organization to see what your options are.

Be aware there are many different configurations of health plans including managed care plans such as health maintenance organizations (HMOs) or preferred provider organizations (PPOs), which are networks of clinicians, which may offer care at a lower cost if you remain within the specified network of providers.

Fee-for-service options typically pay the provider directly for a service performed or reimburse you for that service. This type of arrangement may offer you the widest choice of providers but may be more expensive and require you to file for reimbursement of your costs.

Also note if you have health insurance through your employer or your spouse’s employer and must stop working or reduce your hours because of your illness, you may be able to maintain coverage for 18 months through COBRA (Continuation of Health Coverage).

Obamacare

The Marketplace, offered through the Affordable Care Act (also referred to as Obamacare), offers insurance coverage through private health insurance companies and is subsidized by the government to provide coverage to eligible households that may not qualify for government programs like Medicare or Medicaid. If possible, try to find a plan that allows for you to see doctors who are in and out of your network.

Questions to ask before selecting a plan

While each health insurance plan’s coverage for cancer diagnosis, care and treatment varies, the Affordable Care Act mandates that no one can be dropped or denied health insurance because of a pre-existing condition including cancer. That is why it is essential to understand the many variations as you assess which health insurance plan is best for you.

As you begin researching the types of coverage available to you, consider these questions to the best of your ability:

- What type of cancer treatment will you receive?

- How long will the treatment last?

- Where will you receive the treatment?

- What is your current health insurance coverage?

The answers to these questions as well as an assessment of your financial situation may help you determine whether you can afford a high deductible plan; what doctor or organization is best for your treatment and if they are in-network; if an HSA, HRA (health reimbursement arrangement) or FSA (flexible spending account) is available to you to help offset costs; or if supplemental insurance coverage makes sense.

A comprehensive overview of what various health insurance plans cover for cancer patients as well as other costs associated with cancer care is included on the American Society of Clinical Oncology's cancer.net page.

Does insurance cover cancer treatment?

It’s important to shop around and review what your out-of-pocket costs will be, including premiums, co-pays, deductibles and maximum costs.

Other considerations include:

- Which providers are included in the insurer’s network

- What is covered for specific cancer treatments like surgery and radiation

- What medical supplies like gloves, needles, wheelchairs or nutritional supplements are included

- Are protheses, wigs or mastectomy clothing covered

You may also want to review the plan’s formulary or list of drugs that are covered and whether pre-approval, also known as prior authorization, is required for certain drugs, tests or procedures.

Asking about coverage for home health visits, palliative care, physical therapy, rehabilitation services and mental health counseling may also be important, depending on your situation.

Does insurance cover cancer screening?

Be sure to check if the health insurance plan you are considering covers routine screenings and preventive tests, including genetic testing, for cancer as well as other illnesses. Be aware that some plans make a distinction between routine and diagnostic testing as far as what they will pay.

This information should be included in the plan’s “summary of plan benefits” document.

Many insurance companies cover routine screenings, such as colonoscopies and mammograms, based on government recommendation guidelines.

When to consider a health savings account

HSAs, HRAs and FSAs are special accounts, usually provided through your employer, that allow you to set aside money before taxes to cover certain health care expenses.

The government sets limits on how much may be set aside each year and whether any funds may be carried over from one year to the next. If you can anticipate your health care costs for the coming year, it may behoove you to set aside the maximum amount since these accounts are a good way to defray some health care costs.

Be sure to check with your employer on what accounts may be available to you and how much you and your employer may contribute.

Short-term disability for cancer

To help you continue to receive an income while receiving care and treatment as a cancer patient, you may be eligible to receive Social Security Disability Insurance or SSDI from the U.S. government. Those individuals who have worked long enough to have paid Social Security taxes on their earnings, and who are no longer able to work, including some with a cancer diagnosis, may apply for and receive SSDI income.

To determine your eligibility, you can review the list of cancers the government considers “disabling” on the Social Security website.

Other health benefits to consider

While health insurance coverage may help the financial burden of cancer care and treatment, there are other ways to offset some of the associated costs.

For instance, some medical expenses not typically covered by health insurance may be deductible on federal income taxes, including:

- Mileage for travel to and from medical appointments

- Prescription drugs

- Meals during lengthy medical visits

Check with your accountant or financial advisor on what expenses may qualify.

Other options may also be available to help defray some of the expenses of cancer care. They include the following.

Some local and state non-profit and volunteer organizations offer financial relief programs for those with serious illnesses to help cover out-of-pocket costs for co-pays, co-insurance, premiums and deductibles along with other out-of-pocket costs you may incur.

Some hospitals and cancer centers may offer financial assistance programs.

Pharmaceutical companies often have patient assistance programs to help eligible patients with drug-related or other expenses associated with their care.

Check your local chapter of the American Cancer Society or the United Way for organizations that can help in your area.

If you’ve been diagnosed with cancer and are interested in a second opinion on your diagnosis and treatment plan, call us or chat online with a member of our team.